Architecture

The Ripple Connection

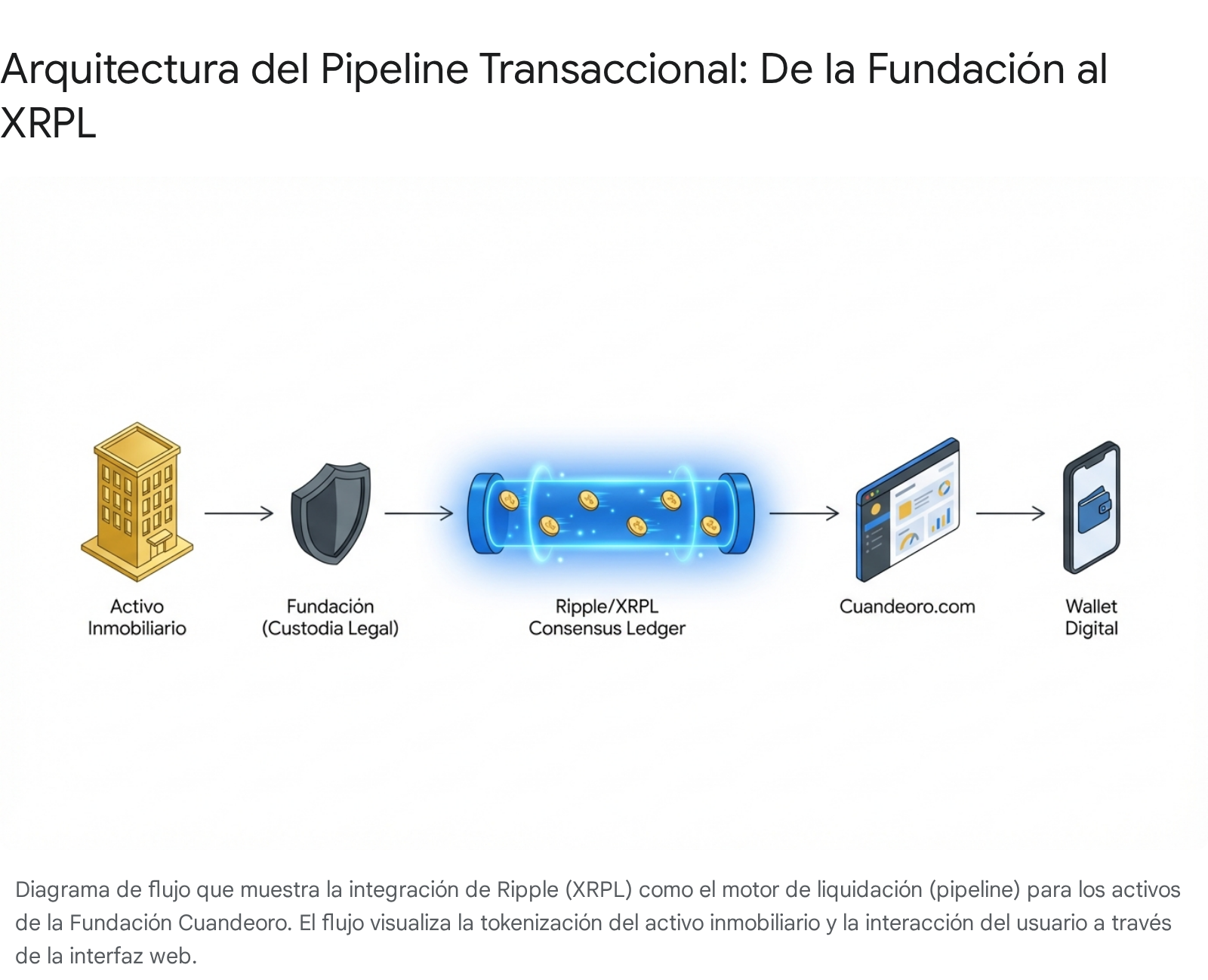

XRPL acts as the settlement rail — the “high-speed lane” — while real-world assets and governance processes sit in the institutional layer. This page explains, at a glance, how the pipeline works and what is verifiable.

Pipeline overview

Step 1 — Asset onboarding

Property and documentation are prepared for tokenisation and disclosure.

Step 2 — On-ledger representation

Tokens represent rights/claims as defined by the programme’s legal and disclosure framework.

Step 3 — Settlement & auditability

XRPL provides fast settlement and public verifiability of transfers.

What you can verify

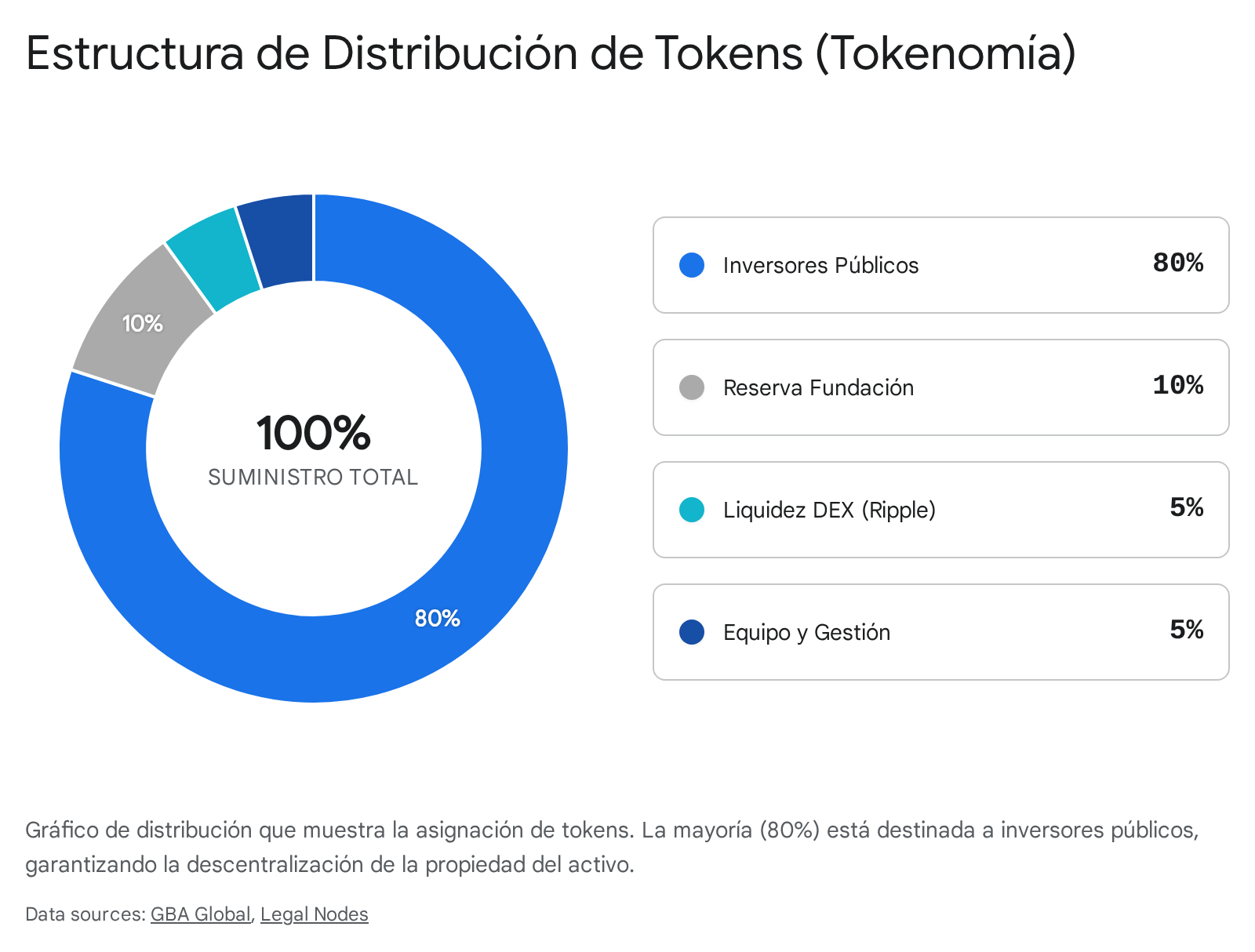

Supply and distribution

Allocation policies are documented in Tokenomics.

Treasury movements

On-ledger transactions can be surfaced on the Transparency page.

Programme rules

Disclosure documents and the Whitepaper provide the operating assumptions and risk statements.

Illustrations

Next

- •Read the Whitepaper for detailed assumptions and risk statements.

- •Review Tokenomics for allocation and lock-up structure.